Геополитика и экогеодинамика регионов.

Том 8 (18). Вып. 2. 2022 г. С. 85–94.

УДК 339.5

Ч. Э. Блессинг1 Ю. В. Соловьёва2

Взаимосвязь между прямыми иностранными инвестициями и внешней торговлей Нигерии

- ФГБОУ ВО «Российский университет дружбы народов», г. Москва, Российская Федерация

e-mail: 1032204792@rudn.ru

- ФГБОУ ВО «Российский университет дружбы народов», г. Москва, Российская Федерация

e-mail: solovyeva-yuv@rudn.ru

Аннотация. В статье рассматривается современное состояние внешнеторговой политики Нигерии, выявляются особенности взаимосвязи между прямыми иностранными инвестициями (ПИИ) и внешней торговлей страны. Анализируются проблемы, с которыми сталкивается нигерийская экономика, оказывающие негативное воздействие на уровень экспорта и импорта, отрицательно сказывающиеся на притоке ПИИ. Авторами даются рекомендации по формированию в Нигерии привлекательной среды для иностранных инвестиций, стимулирования их притока.

Ключевые слова: прямые иностранные инвестиции (ПИИ), внешняя торговля, Нигерия, экономический рост.

Introduction

A country’s ability to attract Foreign Direct Investment (FDI) has been used as a yardstick to measure its economic performance and growth all over the world. FDI is also considered responsible for generating said economic growth in multiple countries, and its complementary relationship with trade is considered to be the basis of economic development in the recipient country.

Globalization is based on the interactions between trade and foreign direct investment (FDI). The OECD has lately developed analytical work to investigate the nature of these linkages in quantitative terms [6; 22]. This study brings together the more technical work done over the last three years.

This empirical study demonstrated the complexity of these connections while also demonstrating their importance. Foreign direct investment has had a significant and favorable impact on international trade, notably since the mid the 1980s. Foreign direct investment boosts the growth of exports from a country, according to empirical findings.

There was a switch in the cause and effect of the two concepts, with FDI stimulating and boosting international trade, especially through exports in the long run, and an increase in imports, technology, jobs, skills, and other benefits on a short-term basis to the host country. These links between the FDI and international trade influenced foreign exchange in the form of increased expertise increased competitiveness between industries, and the transfer of technology and knowledge which have contributed to the diversification and restructuring of the global economy as a whole by promoting innovations from governments, private companies, and institutions,

85

Блессинг Ч. Э., Соловьева Ю. В.

![]()

These countries and their governments have adopted new strategies and innovations to remedy these inadequacies by adopting new trade policies to encourage local competitors and entice foreign investors as well as the use of educational programs and projects in public procurement in an attempt to close this gap.

Nigeria has long been seen as having enormous economic potential, which has attracted major investment. This is due to the size of its people and the availability of natural resources.

However, the country’s vast economic operations expose it to tremendous risk. Rand Merchant Bank’s recent analysis has shown that because the country has little control over the price of crude oil, its overwhelming reliance on it poses a huge threat to the country’s economy.

Furthermore, the country’s bureaucratic approaches to embracing and implementing reforms, as well as the Nigeria’s continual security challenges across its six geopolitical zones have greatly upset the country’s economy.

Poverty, mass unemployment, and a sustained double-digit inflation rate are among the other variables cited. This has had an impact on various parts of the economy, resulting in a decline in the country’s ranking. The operational environment consists of several different components, the performance of which influences the ultimate result. Global competitiveness, economic freedom index, and perception of corruption are the three. The Economic Freedom Index gave Nigeria a score of 51.6 out of 100. The country received a score of 3.4 on the corruption perception index. While it scored average on the economic freedom index, it scored poorly on the corruption perception index.

Ranked at 12th in Africa on the economic activity index, Nigeria has a score of 6.2. This score was made up of a strong 8.7 on market size and below-average performance on the other indexes. It received a 4.4 on the growth index and a 4.2 on the fiscal score. Nigeria received a 4.3 on a scale of 10 in the operational environment index in the 2021 report. This score is below average, placing it 30th out of 54 African countries. Although the result is regarded as poor, it is an improvement from the previous year’s 3.9 scores.

The country’s failure to attract foreign investments in the form of FDIs to its local businesses in recent times is a cause for concern for a country that needs an economic boost.

This paper seeks to evaluate the relationship between Foreign Direct Investment and the foreign trade of Nigeria about the country boosting economic development and growth. After this introductory section, a review of the literary works relating to Foreign Direct Investment and Foreign Trade in Nigeria as well as the challenges the Nigerian economy faces concerning both. Finally, recommendations on what Nigeria should do concerning FDI and its foreign trade to bring about economic development will conclude this paper.

External resources, such as technology, managerial and marketing knowledge, and finance, are used in foreign direct investments. All of this has a significant impact on Nigeria’s production capacity. Sharma R. & Kaur M. [21] posits that there can be a two-way link between trade and FDI i.e., the trade will first cause FDI, then FDI may eventually cause trade. This interconnectedness between them is central to the development of most countries. However, Ebere [4] draws attention to the fact that, if FDI displaces export trade of local firms of the host country, then it will be harmful to the domestic industry of the investing country but if trade and FDI complement each

Взаимосвязь между прямыми иностранными инвестицими и внешней торговлей Нигерии

![]()

other then it might lead to greater competitiveness of the foreign market and this is beneficial to exports from the host country and therefore its industries.

The exchange of goods and services across international borders is what is known as foreign trade. Prof. JL Hanson describes foreign trade as «An exchange of various specialized commodities and services rendered among the corresponding countries is known as foreign trade» [8]. Foreign trade is no different from domestic trade because the motives and behaviors of trade participants do not change fundamentally depending on whether the trade is cross-border.

Giddens described globalization as the «intensification of worldwide social relations that link distant locales in such a way that local happenings are impacted by events taking place miles away and vice versa» [7]. The concepts of «accelerating interdependence» [15], «activity at a distance» [7], and «time-space compression» [9] are all embodied in this term. Balasubramanyan et al. reported positive interactions between human capital and FDI [2]. They had earlier found significant results supporting the assumption that FDI is more important for economic growth in export-promoting than import-substituting countries. This implies that the impact of FDI varies across countries and that trade policy can affect the role of FDI in economic growth. However, in the case of Nigeria, posits [23] that although there is a positive relationship between economic growth (GDP) and FDI, results from their studies showed statistically insignificant findings which could have been as a result of insufficient FDI funds invested into the Nigerian economy which had not been able to significantly impact on the economic growth of the country. The role of Foreign Direct Investment (FDI) has been widely recognized as a growth-enhancing factor in the developing countries. Falki [5], speaking on the effects and advantages of FDI to the host economy, noted that the effects of FDI on the host economy are normally believed to be: increase in employment, augmenting the productivity, boost in exports and amplified pace of transfer of technology. The potential advantages of the FDI to the host economy are: it facilitates the utilization and exploitation of local raw materials, introduces modern techniques of management and marketing, eases the access to new technologies, foreign inflows can be used for financing current account deficits, finance inflows form FDI do not generate repayment of principal or interests (as opposed to external debt) and increases the stock of human capital via on-the-job training. The realization of the importance of FDI had informed the radical and pragmatic economic reforms introduced since the mid-1980s by the Nigerian government. The reforms were designed to increase the attractiveness of Nigeria’s investment opportunities and foster the growing confidence in the economy so as to encourage foreign investors to invest in the economy [17]. However, Export-oriented strategy and the effect of FDI on average growth rate for the period 1970-1985 for the cross-section of 46 countries as well as the sub-sample of countries that are deemed to pursue export-oriented strategy were found to be positive and significant but not significant and, sometimes, negative for the sub-set of countries pursuing inward-oriented strategy [2].

Transnational corporations and financial institutions dominate the global economy, which operates independently of national borders and internal economic factors. As a result, the process exacerbates regional disparities and poverty in emerging countries. Nigeria has not reaped the full benefits of globalization as a result of its heavy reliance on crude oil, difficulty to attract increased international investment, and massive debt. Globalization, on the other hand, can be domesticated in the country through diversifying exports, reducing debt, and expanding development collaboration

Блессинг Ч. Э., Соловьева Ю. В.

![]()

with other countries, as Ugwuegbe S., Okore A. [23] suggest that domestic investment is a major factor that contributes to the growth of the Nigerian economy. And so, more emphasis should be geared towards encouraging domestic investment to drive the economy to the desired level of growth. Ebere U.K. [4], stated that Foreign Direct Investment was found to be a positive and significant function of Trade openness but financial depth (M2GDP) and Real Exchange Rate (REXR) was positive and non-significant. The results from his findings showed that theoretically it was plausible that the more open an economy is with emphasis on trade activities, the greater likely the flow of Foreign Direct Investment into such a country. There is therefore a strong recommendation for a greater measure of trade liberalization to drive foreign direct investment [4]. Despite the insignificant relationship between GDP and FDI, it is important to note that FDI contributes positively to economic growth in Nigeria. The government and the monetary authorities should design policies and programs that will encourage investors to invest in Nigeria. The Nigerian state must also be strengthened as a bulwark against foreign capital’s dictate. With all of this in place, Nigeria will be able to compete with more developed countries, thereby reaping the benefits of globalization.

Materials and methods

The article was written using a systematic approach, comparative and statistical analysis. The research analyzed current international resources (National Bureau of Statistics, data from the Organization for Economic Cooperation and Development, etc.), information and analytical agencies (Nairametrics, The Guardian).

Results and discussion

In 2019, Nigeria attracted $1.2 Billion in Foreign Direct Investments; an increase from the $981million. However, with the new step towards globalization and the involvement of major trade treaties like the African Continental Free Trade Area (AFCTA), Globalization has resulted in a shift of power in the country, a weakening of the globalization state and a decline in social accountability. Corruption is a multifaceted issue and it has deep roots in Nigeria’s bureaucratic and political systems, and its impact on development is varied. Globalization can mitigate this by implementing positive economic impartations such as increased specialization and frequency, better product quality at lower prices, economies of scale in manufacturing, competitiveness and increased output, technological advancements, and improved managerial capabilities.

While costs vary and systemic corruption can coexist with strong economic performance, history shows that corruption is harmful to progress. It causes governments to intervene when they are not compelled to, undermining their authority in the process.

As it stands Nigeria has a foreign portfolio investment of over $12 Billion so there is much room for improvement [10].

The National Bureau of Statistics recently published Nigeria’s capital importation report for the first and second quarters of 2021. According to the report, the nation received a sum of $875.62 million of foreign inflows in Q2 2021, representing a

Взаимосвязь между прямыми иностранными инвестицими и внешней торговлей Нигерии

![]()

significant year-on-year decline [12], culminating in Nigeria’s foreign direct investment falling to its lowest since the year 2010.

| $’Millions |

600

500

400

300

200

100

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021

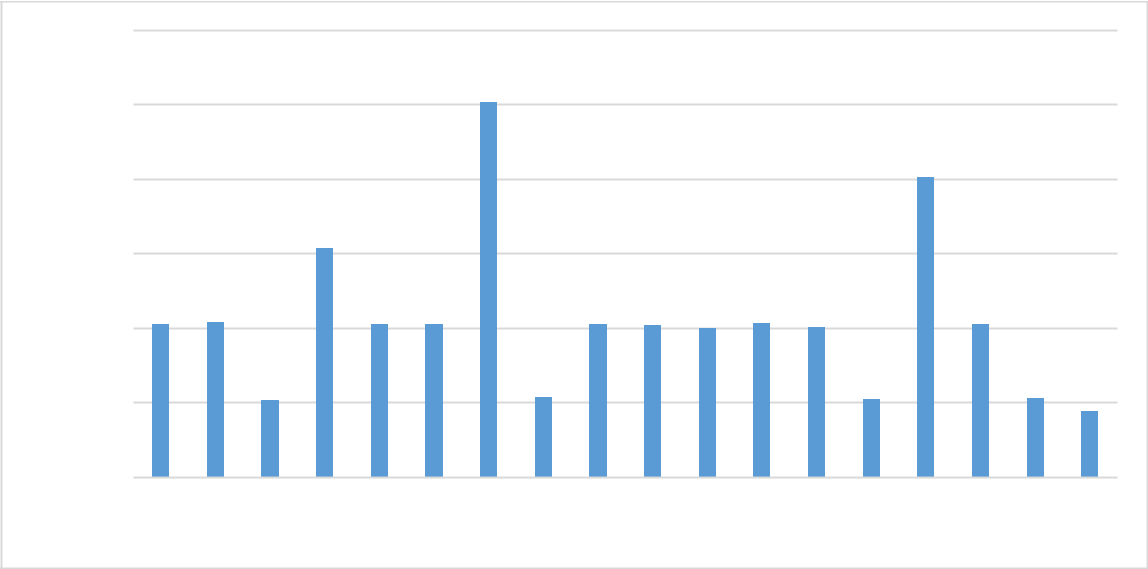

Fig. 1. Foreign Direct Investment into Nigeria (Q1 2017-Q2 2021).

Source: [19]

The fig. 1 shows a graphical representation of the levels of FDI from the first quarter of 2017 to the second quarter of 2021. The reality of this year’s FDI investments still pales in comparison to the previous year, which was affected by the covid-19 pandemic, lockdown measures, and the restrictions on movement.

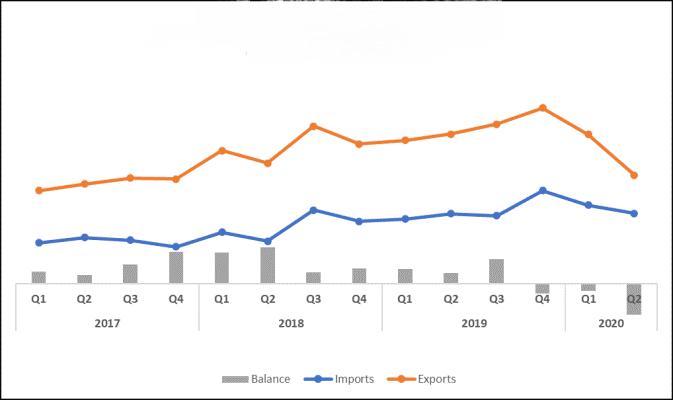

Fig. 2. Summary of foreign trade statistics.

Source: [14]

Блессинг Ч. Э., Соловьева Ю. В.

![]()

The fig. 2 shows the fluctuating levels of foreign trade from the year 2017 to the first two quarters of 2020. Data from a report by the National Bureau of Statistics, indicated a drop in foreign trade by 27.46% year on year in Q2 2020 when compared to 8.61 trillion Naira recorded in the corresponding Q2 2019 [14].

Examining both graphs, the data indicate similarities in the rise and fall of FDI concerning levels in foreign trade. For instance, the gradual rise in both FDI and foreign trade in the first two quarters of 2017 but in Q3 of 2017, there is a slight fall in FDI and imports with exports still rising regardless indicating some correspondence. However, in the second quarter of 2018, there is a slight rise in FDI but the level of both exports and imports experienced a drop then in the third quarter the Nigerian economy witnessed the highest level of FDI inflows in relation to a rapid rise in exports and imports, probably indicating the influence of FDI inflows in the previous year with another sharp decline the Q4 of 2018 in both FDI and foreign trade levels. In the first two quarters of 2020, the Nigerian economy experiences a steep decline in exports and imports as well as FDI inflows due to the effects of lockdowns and the covid-19 pandemic. There isn’t a conclusive or direct link between both data, but there is some influence between them.

Local businesses have been affected by Nigeria’s failure to attract foreign investors recently, and this trend is a cause for concern as it could be detrimental to the economic growth of the country in the long run. This decline in FDI is all due to the West African nation being plagued by problems ranging from socio-economic issues to political instability, poor infrastructure and education to inadequate investment in human capital by the government which has all contributed to creating an environment that is unappealing to foreign investors. The lower price of crude oil and the closure of oil developments sites at the start of the pandemic also play a role in the reduction of direct investment in the Nigerian economy [19]. Nigeria’s trend of protectionist measures and policies under successive governments have also contributed to the fluctuation in the recent inflow of FDI in the past and the present as international businesses face imbalanced constraints while domestic competitors are offered financial advantages. In 2018, FDI was down by 36%. In addition, due to the ongoing security crisis in the country, foreign investment has been reduced drastically with an estimated 1.77trillion lost in 2019 [20]. This decline in foreign investment is also partly responsible for the depressed state of the foreign market as exports and imports are the key features of foreign trade within the foreign market, which has to do with products and services traded at a single or profitable price elsewhere outside the borders of a particular country.

The Nigerian economy is heavily reliant on the exports of crude oil, as the main source of foreign exchange earnings [17]. Before the discovery of crude oil, a significant portion of Nigeria’s revenue emanated from the exportation of agricultural products such as palm oil, groundnut, rubber, and cocoa. However, the discovery of crude oil resulted in the neglect of the agricultural sector as Nigeria’s major export sector [18]. This ‘oil rush’ has enormous implications for Nigeria as an oil-exporting country as it promises both new wealth and a potential severe internal discord over the allocation of oil revenue [20]. From the import perspective, due to Nigeria’s status quo of being underdeveloped, it highly depends on technologically advanced countries such as Germany.

Even though foreign trade still plays a crucial role in the economy as exports (dominated by petroleum) constitute about 80% of GDP, Nigeria is still a major

Взаимосвязь между прямыми иностранными инвестицими и внешней торговлей Нигерии

![]()

importer with commodity imports comprising manufactured goods, chemical products, machinery, transport-related items, and food. In a bid to reduce this import dependency, there has been a consistent and predictable pattern in Nigeria’s trade and industrial policies. For decades, successful Nigerian governments have resorted to protectionist measures, including import restrictions and exchange control, to deal with these problems of import and oil dependencies [13]. According to data from Nigeria’s National Bureau of Statistics (NBS), the amount of money the country has been spending on importing food and drink increased from 2015 to 2017, dipped in 2018 and if the trend from the first quarter of this year continues, the bill will go up again for this year.

In 2015, Nigeria spent nearly $2.9bn (£2.4bn) and by 2017 that had risen to $4.1bn, the NBS says.

The policy of restricting food imports does have some merits, but the policy cannot be introduced in isolation.

Agricultural economist Idris Ayinde argues that restricting food imports should be a gradual process since the country cannot yet meet domestic demand for most food commodities, and the policy risks increasing food price inflation further.

Local rice production has increased, but the foreign exchange ban was coupled with policies aimed at supporting farmers through subsidies and loans. In 2015, the Central Bank of Nigeria (CBN) banned importers of 41 foreign products from accessing the foreign exchange market. The immediate trigger for this policy was the plummeting exchange rate of the Naira, which had dropped by almost 20% in 2014. Then in 2019, the Federal Government followed the well-trodden protectionist path of previous governments and announced a land-border closure in the four sectors: Northwest, Southwest, North Central, and South-South [20], which had major positive and negative effects on the country’s foreign trade since then. Positively it in inspired a list of new producers to launch into a new industry with little to no competition.

Due to the complementary nature of the relationship between FDI and trade, the problems and challenges that plague the Nigerian economy’s ability to attract foreign direct investment inflows to the country would in turn affect its exports and imports negatively to an extent. Nigeria has relied heavily on its endowment of natural resources to attract foreign investors in the last few years, and its economy requires reforms like trade liberalization as an example, to encourage foreign investors to invest more in the country.

Trade liberalization is the removal or reduction of restrictions and barriers to the free exchange of goods between nations. These barriers include tariffs and licensing rules such as tariffs and surcharges, and non-tariff barriers such as quotas. Economists often view the easing or eradication of these restrictions as steps to promote free trade

- It has implications for income distribution, environmental stability, economic growth, and development. Some of these effects may have positive impacts on such countries, while others affect the countries negatively [11]. By promoting free trade, trade liberalization policies often encourage investment in a country due to the economy being open to foreign investors which in turn brings about greater competition. Proponents of trade liberalization claim that it ultimately lowers consumer costs, increase efficiency, and fosters economic growth [3]. In short, trade liberalization can generate considerable economic benefits, but these benefits may not be evenly distributed. The success of trade liberalization depends on how flexible an economy is

Блессинг Ч. Э., Соловьева Ю. В.

![]()

Nigeria’s import restrictions drastically limit international trade and risk harming relations with its foreign trade partners. Under the World Trade policy review and the IMF, Nigeria’s trade policy regimes are classified as one of the most restrictive in the world. Its global reputation as well as the Central Bank’s continued push for protectionist policies to date have deter foreign investors and prospective business partners from partnering with Nigeria, which in turn has affected the inflow of FDI into the country. Despite the trend of protectionist policies, Nigeria signed several bilateral agreements aimed at enhancing relations with other countries globally, increasing Foreign Direct Investment (FDI), and boosting economic growth.

Nigeria can do a few things to increase foreign direct investment. It must, first and foremost, play fairly. Businesses from abroad and within the country should be treated similarly. All types of businesses should be open, transparent, and dependable.

Infrastructure is another aspect that needs attention. Businesses require easy access to ports, a sufficient and consistent supply of energy, and the assurance that the country will be a favorable place to invest. FDI is also encouraged by good institutions.

Partnerships between foreign and domestic firms should be encouraged by the government. Foreign companies may be conversant with global best practices, but local companies will be more comfortable with the local environment. This combination has the potential to be extremely useful.

Nigeria’s regional administrations must also be involved: the country is divided into numerous regions, each with its own set of opportunities and difficulties. When the Nigerian central government ran out of ideas and foreign investors wanted to leave the agricultural sector, the regional government of Kwara State stepped in to create a positive business climate based on the cooperation of local banks, community members, and foreign investors, culminating in the Shonga farms public-private partnership.

This has allowed the company to remain in Nigeria. It’s also attracted private investors, supporting the company and the local economy.

References

- Balasubramanyam V. N., Salisu M., Sapsfold D. Foreign Direct Investment as an Engine of Growth // Journal of International Trade and Economic Development.

1999. № 8(1). Pp. 27-40.

- Balasubramanyam V. N., Salisu M., Sapsford D. Foreign Direct Investment and Growth in EP and IS countries // Economic Journal. 1996. № 106. Pp. 92-105.

- Banton C. Trade Liberalization. URL: www.investopedia.com/terms/t/trade-liberalization.asp

- Ebere U. K. Responsiveness of Foreign Direct Investment to Trade Openness in Nigeria // Research Journal of Economics. 2016. Vol. 4. Issue 5. URL: www.researchgate.net/publication/305326504_Responsiveness_Of_Foreign_Direct_ Investment_To_Trade_Openness_In_Nigeria

- Falki N. Impact of foreign direct investment on economic growth in Pakistan // International Review of Business Research Papers. 2009. № 5(5). Pp. 110-120.

- Fontaine L. Foreign Direct Investment and International Trade: Complements or Substitutes? OECD Science, Technology and Industry Working Papers, 1999. URL: www.oecd-ilibrary.org/science-and-technology/foreign-direct-investment-and-international-trade_788565713012

Взаимосвязь между прямыми иностранными инвестицими и внешней торговлей Нигерии

![]()

- Giddens A. The Consequences of Modernity. Polity Press. Cambridge, 1991. URL: https://voidnetwork.gr/wp-content/uploads/2016/10/The-Consequences-of-Modernity-by-Anthony-Giddens.pdf

- Hanson J. The structure of modern commerce. Foreign trade: Definitions, Types of

Foreign trade. URL: www.iedunote.com/foreign-trade

- Harvey D. The Condition of Postmodernity: an enquiry into the origins of cultural

change. Massachusetts: Blackwell Publishing, 1989. URL:

https://selforganizedseminar.files.wordpress.com/2011/07/harvey_condition_postmo

dern.pdf

10. How AFCTA affects every Nigerian Business. URL:

https://nairametrics.com/2019/07/08/how-afcfta-affects-your-business-benefits-and-disadvantages/

- Ivy Panda. Trade liberalization. URL: https://ivypanda.com/essays/trade-liberalization/#ivy-csf-section

- National Capital Importation. National Bureau of Statistics. URL: https://nigerianstat.gov.ng/

- Nigeria’s import restrictions: A bad policy that harms trade relations. Economics and

Political Science. URL: https://blogs.lse.ac.uk/africaatlse/2015/08/17/nigerias-import-restrictions-a-bad-policy-that-harms-trade-relations/

- Nigeria’s total foreign trade drops to 6.24 trillion Naira in Q2 2020, export plunges by 52%. URL: https://nairametrics.com/2020/09/02/nigerias-total-foreign-trade-drops-to-n6-24-trillion-in-q2-2020-export-plunges-by-52/

- Ohmae K. Managing in a Borderless World. Harvard Business Review. 1989. № 67

(3). Pp. 52-61.

- Ogunlesi T. Notes on Nigeria’s Land Border Closure. URL: https://toluogunlesi.medium.com/notes-on-nigerias-border-closure-aug-2019-dec-2020-9903188cfb9d

- Ojo M.O. Developing Nigeria Industrial Capacity: via Capital Market. Abuja // CBN Bulletin. 1998. Vol. 22, No.3 July/Sept.

- Oxide MG, Ojide KC Growth Evidence of Imports in Nigeria: A Time Series Analysis. International Researcher, 2014. Vol. 3(2). Issue 2. Pp. 46-54. URL: www.researchgate.net/publication/264156420_Growth_Evidence_of_Imports_in_Ni geria_A_Time_Series_Analysis

- Owolabi-Merus O., Odediran O.K., Inuk U.E. An Investigation into the Impact of International Trade in the growth of Nigeria’s Economy. International Letters of Social and Humanistic Sciences. 2015. Vol. 61. Pp. 116-125. URL: www.scipress.com/ILSHS.61.116

- Oyekanmi S. Foreign direct investment into Nigeria slumps to its lowest in 11 years. Nairametrics, August 2021. URL: https://nairametrics.com/2021/08/02/foreign-direct-investment-into-nigeria-slumps-to-its-lowest-in-11-years/

- Sharma R., Kaur M. Casual Links between Foreign Direct Investments and Trade: A Comparative Study of India and China. Eurasian Journal of Business and Economics. 2013. Vol. 6 (11). Pp. 53-66. URL: https://oaji.net/articles/2014/1269-1410857402.pdf

- The Benchmark Definition of Foreign Direct Investment. OECD Benchmark

Definition of Foreign Direct Investment. URL: www.oecd.org/investment/fdibenchmarkdefinition.htm

Блессинг Ч. Э., Соловьева Ю. В.

![]()

- Ugwuegbe S., Okore A. The Impact of Foreign Direct Investment on the Nigerian Economy // European Journal of Business and Management. 2013. Issue 5(2).

Ch. A. Blessing1 Yu. V. Solovieva2

Relationship between Foreign Direct Investment and Foreign Trade of Nigeria

1Peoples’ Friendship University of Russia (RUDN University), Department of National Economics, Moscow

e-mail: 1032204792@rudn.ru

2Peoples’ Friendship University of Russia (RUDN University), Department of National Economics, Moscow

e-mail: solovyeva-yuv@rudn.ru

Abstract. The article discusses the current state of Nigeria’s foreign trade policy, identifies the peculiarities of the relationship between foreign direct investment (FDI) and the country’s foreign trade. The problems faced by the Nigerian economy, which have a negative impact on the level of exports and imports, have a negative impact on the inflow of FDI, are analyzed. The authors make recommendations on the formation in Nigeria of an attractive environment for foreign investment, stimulating their inflow. Keywords: foreign direct investment (FDI), foreign trade, Nigeria, economic growth.

Поступила в редакцию 22.01.2022 г.